2020 will definitely be a year to remember, although many of us may prefer to forget it. With a global pandemic, domestic political divide, global trade tension, and record unemployment, this was a year that wreaked havoc on some industries and benefited others. With restaurants, travel industry, gyms, and large event businesses all but shut-down, many businesses did not survive and are still struggling while waiting for business to return to normal. However, there were a handful of industries that benefited from the change in consumer habits such as grocery stores, delivery services, tech companies, and online services and sales.

The real estate industry had similar ups and downs. In the residential markets we saw a migration from larger cities to smaller towns that led to decreasing sales in major metro markets and a surge in sales in smaller suburban areas. Northern Michigan’s residential market was no exception and sales hit an all-time record for the number of homes sold and prices of homes. The commercial market in Northern Michigan was mixed. Transactions were very scarce the first half of the year while businesses waited to see how the pandemic would affect their industries. When business re-opened in the second half of the year we saw record low interest rates, rising stock market valuations, and pockets of industries and investors flush with cash. This lead to a strong desire to purchase real estate and the market rebounded. The year ended mixed with the largest gains in sales volume in the sectors that lost the most value in prices, such as retail.

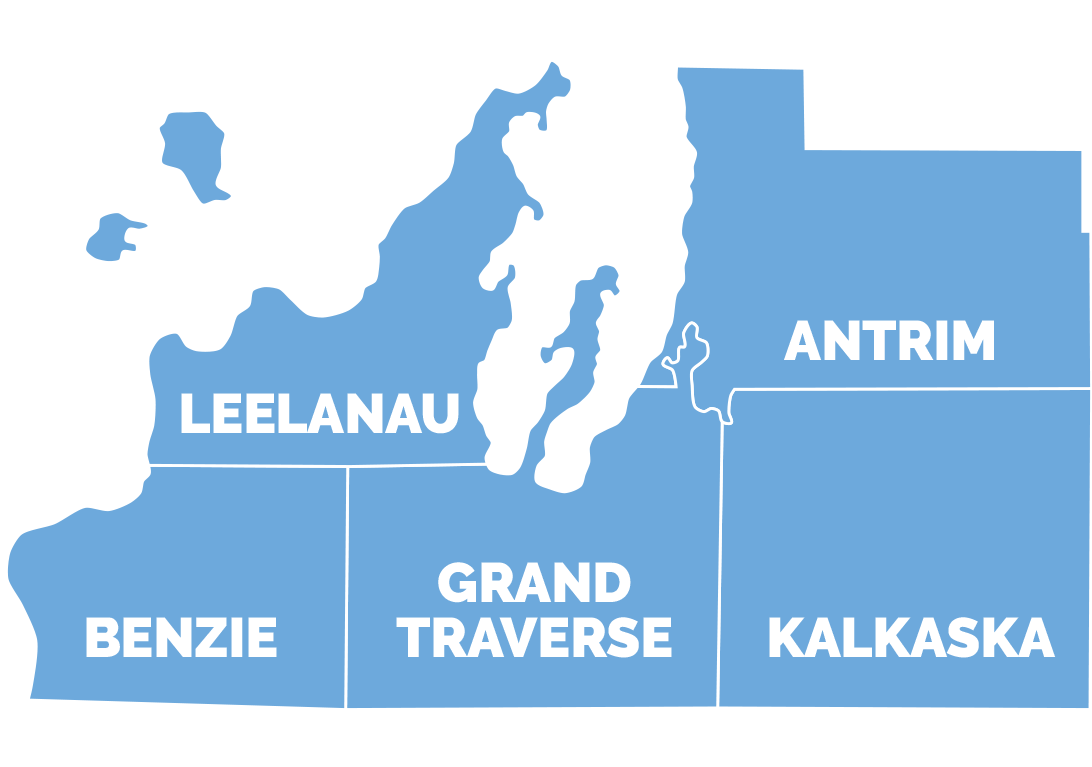

As reported in Northern Great Lakes Realtors MLS (NGLRMLS), there were 82 commercial properties sold in Grand Traverse County in 2020 (an increase from 67 the prior year). The average sale price decreased 28% from $516,400 to $371,600. It should be noted that we had a surge in sales of mini-storage condominiums that accounted for 38 of these sales. With an average price of $105,000 for mini-storage, and sales accounting for almost half of all the commercial sales for the year, it is not surprising the average sale price dropped significantly. However, the price per square foot for industrial, office and multi-family rose in 2020. Within the larger 5 county area (Grand Traverse, Leelanau, Antrim, Kalkaska & Benzie Counties), the commercial sales totaled 150 properties, which was up from 122 properties the prior year, with the average sale prices decreasing 18% to $350,000, again due to the increase in mini-storage sales.

Below is a breakdown of the commercial sales reported in NGLRMLS into the categories of industrial, office, retail, multi-family, and vacant land. This helps gain a better understanding of the values and trends of our commercial real estate based on each property type.

Industrial/Warehouse Buildings – The Industrial market remains in tight supply and prices in Grand Traverse County continued their upward trend averaging $79/square foot, a 30% increase over the previous year. However, total sales volume was down 26% and total square feet sold was down 43% to 121,500 SF of sold space. The average price for the five-county area was $55/SF which was actually a slight dip from an average of $57/SF in 2019 and total sold square footage sold was down 13%. As noted earlier, sales of mini-storage units reached an all-time high of 38 units, creating a new market that we will begin to track more closely.

Office & Medical Office – The office market showed a stronger sale price per square foot, but saw the largest decline of any sector in the amount of space sold. Grand Traverse County had 7 sales totaling 22,000 square feet compared to 2019’s 19 sales of 96,000 square feet. The five-county area saw a similar decline in sales with sales volume down 73% from the prior year. Prices rose with the average price per square foot in Grand Traverse County increasing 25% to $136/SF and the 5-county area increasing 13% to $128/SF.

Only one Medical office building was reported as sold in 2020 in the five-county area. While it is not enough data to draw any trends, the price per square foot was $143 which was down 10% from the one sale the previous year. Medical buildings continue to be difficult to sell as medial practices continue to consolidate and have pandemic related disruptions to business.

Retail – Retail prices were down 28% to $147/SF in Grand Traverse County. This helped spur sales in the sector and the total square footage sold increased 48% to 58,000 SF. Likewise, the 5-county area saw prices decrease from $160/SF to $135/SF and sales increased from 61,000 SF to 100,000 SF in 2020. Past years had inflated sale prices from marijuana dispensaries looking for locations, so 2020 marked both a return to normalcy and continued weakness in the retail sector.

Multi-Family Housing – Multi-family continued to gain in 2020, but at a more reasonable rate. In Grand Traverse County, there were 94 units sold in 2020 up from 67 the previous year. Sale prices increased 4% with the average sale price hitting $106,400 per apartment unit. New multi-family developments continue to be constructed and occupancy rates have been high. Sales in this sector continue to be limited due to a lack of available inventory for sale.

Vacant Commercial Land – Despite the pandemic, development continued throughout the downtown area with financial institutions and residential short-term rental buildings continuing to fuel the demand. Many of the development sites that sold this year were not listed in the MLS and others were not listed as vacant land because they had existing buildings that were torn down. The sales that were reported in the MLS showed about the same number of sales as the previous year and no change in the price/acre, but there were many more ‘off-market’ deals than in the past. Often when prices reach very lofty levels, sellers are willing to sell but don’t want to advertise the price that it would take to motivate them, so the properties are not listed. Like the last few years, there was a wide range of pricing, and downtown had multiple properties selling for over $100/square foot. The sites commanding the highest prices were the ones that are zoned to allow for condominiums that can be rented on a daily or weekly basis.

Leasing Activities – Leasing activity in Grand Traverse County remained fairly flat with 95 properties leased in Grand Traverse County compared to 96 the year before. The percent of properties that leased dipped down to 41% which was the lowest level since 2012. While Industrial space continued to lead in the highest volume of leases, offices were a close second. However, many of the office spaces that leased were smaller offices used by individual workers looking to get out of their homes and have their own space.

Dan Stiebel, CCIM

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link