There has been a lot of conjecture that tax rates will increase over the next few years. Government spending is reaching record highs with stimulus programs aimed to combat the economic effects of Covid-19 shutdowns. President Biden has proposed eliminating the “step-up in basis” provision for inherited assets as well as eliminating the long-term capital gains tax rate. If that happens long-term gains will be taxed the same as regular income. While these proposals may not get passed, increased spending on vaccinations, social programs, environmental concerns, public infrastructure, and education will increase the pressure to raise tax rates.

If the long-term capital gains rate is eliminated and becomes the same as the ordinary income tax rate, taxes would increase from 20% to 40% for the highest earners. This may change the way investors look at tax deferred property sales, known as 1031 exchanges. This is a section of the Internal Revenue Code (IRC-1031) that allows an investor to sell a property for a gain and not pay taxes on the gain if they keep those funds with a qualified intermediary and re-invest the proceeds into a “like-kind” property within a certain time frame.

“Why wouldn’t I still want to do a 1031 exchange, isn’t it always better not to pay taxes when you don’t have to?” The answer to this depends on the investor’s time frame for holding the asset. If an investor plans to keep the replacement property for the rest of their life or keep doing exchanges, this may hold true since they will have more money available to invest in new properties. If the step-up basis is not eliminated, this is a great tax strategy for passing assets on to your offspring and heirs. However, if the property is taxed upon your death at the original basis, there will be a much larger tax bill than if taxes had been paid at the time of each sale and the basis of the inherited property was higher. Similarly, if the investor plans to sell the property and use the proceeds in their lifetime, often done to fund retirement living, the investor would have a larger gain upon sale if they completed a 1031 exchange. When the capital gains tax rate remains steady (say at 20%), this will be a net gain to the investor because they are able to use funds that would have been paid in taxes to grow their wealth.

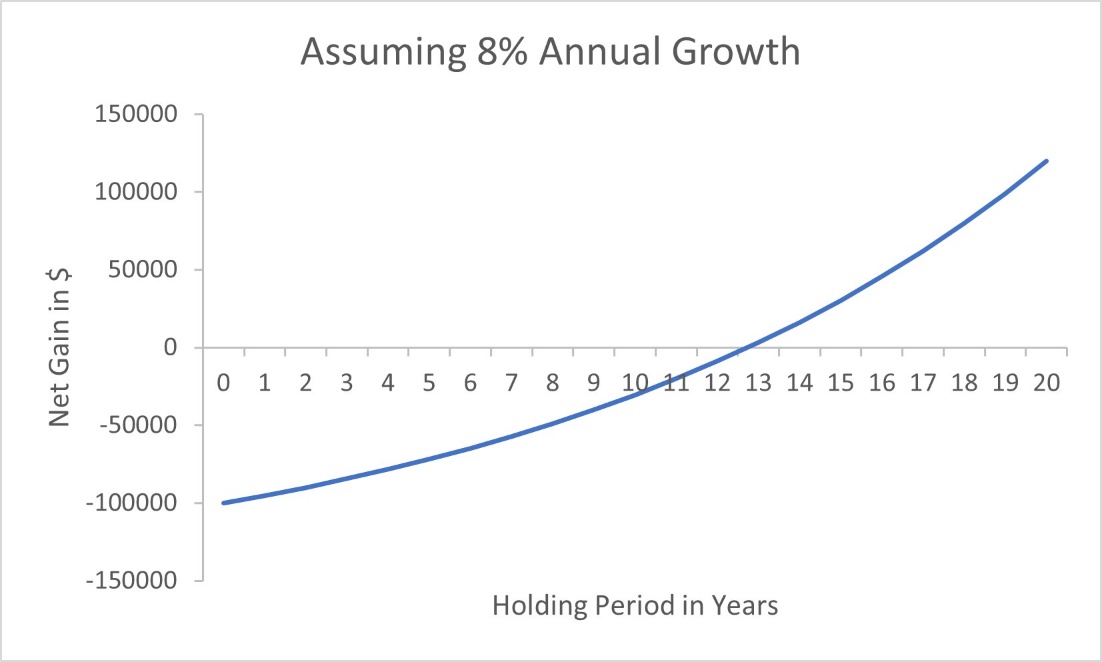

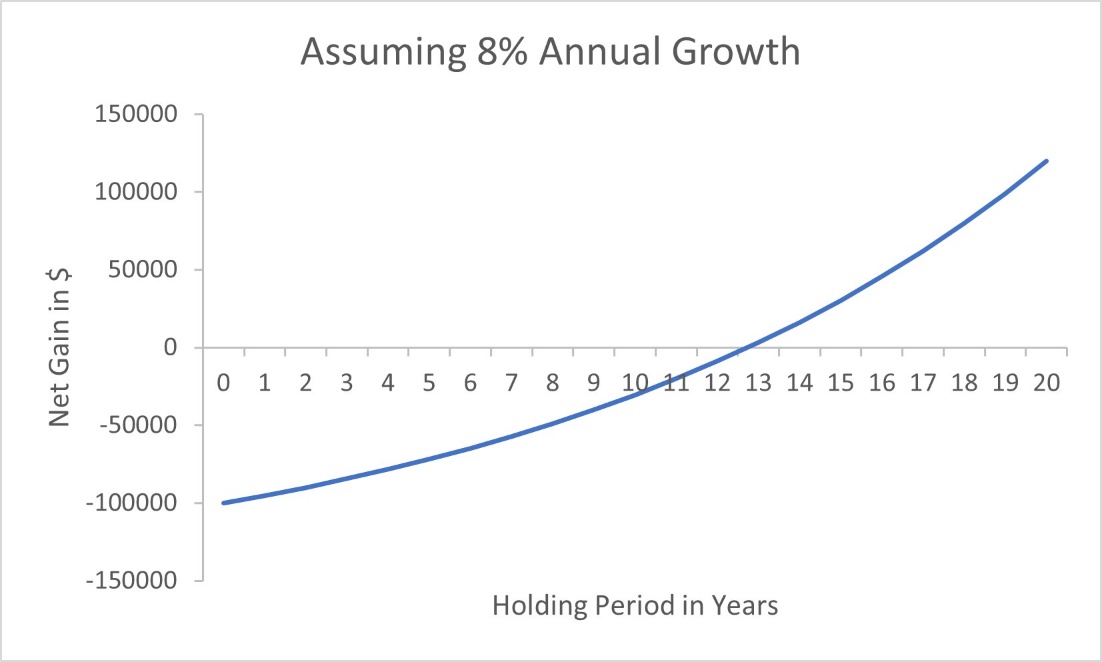

“What happens if the capital gains tax increases to 40% after I do my 1031 exchange?” The financial implication depends on how long you plan to hold the new property and on your rate of return. Take this simplified example: You sell a property and have a $500,000 gain on the property. If you pay the taxes this year at the 20% capital gains rate, you will pay $100,000 in taxes on the gain.

- If you do a 1031 exchange and buy a new property with an 8% rate of return, the $100,000 not paid in taxes would grow to $147,000 in 5 years. That’s $47,000 more than you would have had without the exchange. But if you sell the property after 5 years and the capital gains rate increases to 40%, you will now pay taxes on the original $500,000 plus the $47,000 gain at 40% which would be a tax bill of $218,800. That is $71,800 more in taxes than the original tax savings of $100,000 plus the extra $47,000 earned.

- Contrarily, if you held the same property for 15 years, the $100,000 would grow to $317,000, a $217,000 gain. If the tax rate is 40% in 15 years, you would owe taxes of $286,900 ($500,000 + $217,000 at 40%). This would net you $30,300 more than if you had not done the 1031 exchange ($317,000-$286,800).

1031 Exchange Calculator

In this example, the break-even holding period is between 12-13 years for the asset. If the investor plans to sell the replacement property and use the funds in less than 12 years, they are better off not doing the exchange. If they plan to keep it 13 years or longer, they will end up with a higher rate of return after taxes, if they do the 1031 exchange.

The break-even holding period changes based on the anticipated rate of return. For example, if we run the same scenario with a 12% annual rate of return, the investor only needs to hold the asset for 8 years before it makes financial sense to do a 1031 exchange. Likewise, a 20% return (often attainable when factoring the leverage of borrowing at today’s low interest rates) would only require a 5-year holding period before it became advantageous to do the exchange.

Tax rates will not increase to 40% for everyone (and could be more for some). In order to determine whether a 1031 exchange makes sense, each investor must project their future anticipated tax rate, the annual return on the investment, and how long they plan to own the property. I have created a basic calculator that graphs the holding period needed to return a profit on a 1031 exchange in the face of rising tax rates. If you change the input cells you can customize it to your individual situation and run multiple projections. You will also see that if tax rates remain the same or decrease, it will always be financially beneficial to do the 1031 exchange.

While 1031 exchanges have been a great wealth building tool in the past, investors must factor in the possibility of increasing taxes when determining the benefits of doing this exchange. I ran this past Jim Taylor, a CPA at DGN with a good deal of real estate tax knowledge, and he was quick to point out that tax policies change with each administration, so a change in the next 4 years would not necessarily remain the same when the investor sells. He also pointed out the following reasons and disposition strategies that might make an investor consider doing a 1031 exchange anyway:

- Live to fight another day (keep the funds) in case the tax laws change back

- Keep the ability to control income in the future to qualify for capital gains based on lower income when your income might be lower (ie retirement)

- Use installment sales to qualify for lower income by spreading out the gain

- Use a cash out refi to extract cash but continue to defer gain

- Gift / bequest the property to lower income beneficiaries and then sell to get capital gains treatment / or lower rate treatment

- Time the future sale with a deduction event (ie a big charitable deduction or investment loss)

- Use a charitable trust to contribute the property and shelter the gain

For many, the 1031 exchange will remain the best investment strategy, but for those with a shorter holding period or lower leverage and return rate, it might make more sense to pay the taxes this year and reinvest the after-tax proceeds into a new property.

Dan Stiebel, CCIM

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link