Commercial Purchase Agreements

Pitfalls and Consequences You Should Know

When presenting an offer to purchase real property, the offer is written as a letter of intent (LOI) or a purchase agreement. A purchase agreement becomes a binding contract once both parties have signed it and often a letter of intent is also binding once it has been signed. It is important to understand all of the terms in the agreement so that both parties know what they are committing to in advance.

Commercial purchase agreements can be complicated and I often receive offers from other agents that are not familiar with all of the clauses and do not fully understand how they affect their customers. Below are six points that often confuse buyers and sellers and are important to understand when using a standardized commercial purchase agreement, such as the Michigan Commercial Alliance of Realtors (MICAR) form that is most often used in our market.

Tax Prorations

One of the most confusing issues is how we prorate taxes at closing. Because every township has different tax millages that cover various periods of time, and some are paid at the beginning of the taxing period and others at the end of the period, taxes are almost never prorated based on the actual millage of the township. Instead, the purchase agreement states that taxes will be prorated as if they cover a certain period of time.

Most often we see taxes prorated as if they cover the current calendar year. Buyers and sellers need to understand that the winter tax bill, which comes out in December but is often not paid until January or February, covers the previous year and not the following year. This is because state law says the bill is “due” the day it comes out (December 1), even though taxpayers have a grace period to pay until January or February before there is a late charge.

Another method often written into purchase agreements is where taxes are prorated as if they are paid in advance. This is the state statute and is used if there is a dispute or unclear language in the offer. It is also typically a standard use in southern Michigan, so offers from agents in that area often include this language. When prorating taxes as if they are paid in advance, the seller gets credited for taxes previously paid, so it is beneficial for a seller to use this method.

A third method is to prorate taxes as if they are paid in arrears. This is not as common, but it is important to understand that this single word change from advance to arrears will shift the payment of an entire year of taxes onto the seller. This benefits the buyer and could save the buyer tens of thousands of dollars depending on the annual taxes.

Time Frames

There are many contingencies that specify how long a buyer will have to perform due diligence. It is important to understand that many of these do not begin the day the agreement is signed (which is referred to as the “effective date”), but begin after another event has occurred.

For example, if the MICAR purchase agreement says that a buyer has 30 days to do a survey, it further specifies that the 30 days begins once the seller has provided the title work to the buyer. The title work is needed for the surveyor, so it makes sense, but that could easily add another 30 days if that is how long it takes to get the title work.

Another time frame to be aware of in the MICAR agreement is the time to receive a loan commitment. Many agents think the loan must be secured within the number of days stated, however the agreement reads that if the buyer has not received a loan commitment within the specified time frame, the seller may terminate the offer. If the seller does not terminate, the loan contingency is not removed, it just continues until the buyer has received their loan or waives the contingency.

Default Provisions and Penalties

It is important to understand what happens if there is a default. The buyer often escrows a good faith deposit with the offer. Some offers limit the buyer’s penalty to the amount of the deposit if there is a default. Other agreements give the seller the right of specific performance, which allows the seller to force the buyer to purchase the property. This can be difficult to enforce if the property is being financed or there are unfulfilled contingencies, however a cash offer with no contingencies would certainly be enforceable. Conversely, if the seller defaults, the Buyer often has the right to specific performance, however, if the seller wrote their default clause to only allow for termination of the contract, the buyer may lose the money they have spent on due diligence.

Due Diligence Costs

Since the offer is a contract, all of the terms are negotiable until the contract is signed. We often see buyers and sellers negotiating who will pay for environmental assessments, new surveys that are needed, and closing costs. How the expenses are allocated often follows our economic cycle. We are currently in a strong seller’s market, and buyers are paying most of these expenses, however, a decade ago when it was a buyer’s market, we saw the sellers picking up many more of these costs.

Contingencies

There are many standard contingencies such as inspections, financing, survey, title, environmental, and financials. The buyer must do due diligence to make sure the property meets their expectations. It is equally important that it works for the buyer’s use.

If a special use permit is needed or zoning does not allow for the buyer to use the property the way they intend to, the buyer shouldn’t buy the property. There may be special considerations for additional contingencies such as getting a buyer’s use approved or needing township approval for a site plan. For example, in new construction where there is a new driveway needed, the department of transportation may require a traffic study to be done and may require a road widening or turn lane if the new development will put too much traffic on the road. This could be cost-prohibitive for the buyer and it is important to make sure that contingencies address any requirements a buyer may have.

Price Allocation

It is important to make sure that the sale price is allocated between the real estate, personal property, inventory, and goodwill, if these exist. The buyer and seller must agree on how the price is allocated and there could be considerable tax advantages to one party for doing it a certain way. For the seller, they will need to know their basis in each of these items to understand their tax consequences. Discussing this allocation with your CPA before closing is important for both buyers and sellers.

There are numerous other issues to watch out for in real estate contracts such as the type of deed, title insurance, who pays which closing costs, and many others. It is difficult to anticipate all of the different issues that could arise, but it is easy to remember that the terms are negotiable and you will benefit from working with an experienced team that includes your commercial real estate agent, accountant, and attorneys when creating commercial real estate contracts.

Note: This is not meant to be a comprehensive list of all concerns, but ones that are seen most often in day-to-day business.

Dan Stiebel, CCIM

6 Ways to Value Commercial Real Estate

There are a multitude of methods that can be used to evaluate real estate and the one a buyer chooses should depend on the type of property they are considering and their investment goals. Last month, I delved into an explanation on Cap Rates and how they are used to measure investment performance for commercial real estate.

A cap rate is a great tool for evaluating property with income, but it may not be the best choice if the property does not have steady rents, predictable expenses, or is purchased with financing. Knowing the methods and choosing the best valuation technique suited for a particular situation will help ensure a buyer’s investment goals are reached. Here are six other methods of evaluation that buyers should consider using when thinking about a real estate purchase:

Comparable Sales Method

Often used for residential properties and those without an income stream, studying comparable property sales is a great way of determining a non-income producing property’s value. This method examines similar properties and makes adjustments for the property location, size, age, and other features to determine the subject property’s value. As we have seen in the current residential market, supply and demand influence pricing. The comparable sales method captures the current market trends when income is not a factor and is a good method for evaluating vacant land values.

Return on Investment (ROI)

ROI is one of the most important factors to look at for investment real estate. Cap rates are one of the most widely used methods for determining a property’s income potential, but they are limited to a one-year snapshot of the property and they do not include an analysis for financing even though most properties are purchased with leverage. Here are three other ways to evaluate a property’s return on investment:

- Cash-on-Cash – This is a method that factors in financing by looking at the investor’s return based on the cash they have invested in the real estate, instead of the total purchase price of the property. If a property costs $1,000,000 and a buyer finances $800,000, the buyer commits $200,000 of cash. If the property has a net operating income (NOI) of $90,000 per year and the principal and interest payments are $55,000/year, the buyer will receive $35,000/year. The investor’s cash on cash return is 17.5% annually ($35,000 in income divided by $200,000 investment = 17.5%). A cap rate analysis would show this was a 9% return based on an all-cash purchase ($90,0000 divided by $1,000,000). When interest rates are low, the cash-on-cash return is often much higher than the cap rate, allowing the investor to leverage higher returns on their money. When interest rates are higher and approach the cap rate or exceed it, the cash-on-cash return will be negative and leverage may erode the investor’s ability to earn a positive return on the asset.

- Discounted Cash Flow – This method can be used with cash-on-cash and is a method that calculates future income based on changes in rent, vacancies, operating expenses, and one-time capital expenses. It is used to determine the amount of money an investor would receive, adjusted for the time value of money, which assumes today’s dollar is worth more than the future dollar. If the expected cash flow is $35,000 this year, $40,000 next year, and $45,000 the third year and we use a discounted cash flow rate of 3% (assuming inflation will run about 3% or that we could earn 3% on alternative investments) we can determine the DCF. The current value of the future cash flows would be $35,000 plus $38,835 ($40,000 divided by 1.03) plus $42,417 ($45,000 divided by 1.03 twice), which is $116,252. When we annualize this figure, it averages $38,750 per year, which would be a cash-on-cash return of 19.4% based on our previous example of a $200,000 down payment.

- Internal Rate of Return (IRR) – This is an approach that takes the two previous methods and adds factors such as the holding period (the value when the property is sold) and changes in rental income/expenses on an annual basis. This is a more robust method for determining value and is very useful when investors have different anticipated holding periods for their real estate. The CCIM model uses IRR for comparing investment properties; and I find this the best method for determining long-term projections of an investment. It can get quite complex and is best demonstrated on an excel spreadsheet that shows annual cash flows after expenses, principal and interest, and then a final payment that includes the cash received after selling the property and paying off the remaining mortgage. These cash flows are then used to determine the rate of return an investor would receive based on the initial investment in the property.

Gross Rent Multiplier (GRM)

This is a simplified method that can be used to appraise properties based on income and does not include expenses. GRM may be useful when expenses are not reported, not accurate, or vary greatly from property to property. This is the case when a property is not managed well or when an owner might be taking a salary that is not commensurate with the amount of time worked. It may be helpful for an apartment investor that knows what their expenses run and they use the income to determine the value. For example, let’s say commercial property sold for $1,000,000, with an annual income (before expenses) of $200,000. To calculate its GRM, we divide the sale price by the annual rental income: $1,000,000 ÷ $200,000 = 5. Assuming the GRM is 5 for other similar properties, we can then determine that if a property has an income of $150,000, it should be valued at $750,0000 (income of $150,000 multiplied by GRM of 5).

Cost Approach

This is the best method for new construction or a specialty use building such as a school, church, or club. The value is derived from a land value and the cost to build the existing structure on the property. The cost of new construction is then depreciated based on the age of the property to determine a fair market value. This method does not look at the income, so it is not often used for investment properties; but it is very useful in some instances, such as appraising the value of a building that is to be built or just recently completed, but not yet rented.

Knowing some different evaluation methods can help an investor decide which will be best for their specific scenario. Countless other methods may be considered such as cost per door (a quick initial approach for large hotels and apartment complexes) and cost per rentable square foot. This list is not meant to be all-inclusive but is a good introduction to knowing different methods, and using the right one can be vital to the long-term success of the investor.

Dan Stiebel, CCIM

What is a Cap Rate?

It is rare to have a conversation about investment real estate without the term “cap rate” being mentioned. Cap rate is short for capitalization rate and represents the relationship between a property’s value and its income. It is a snapshot of the property’s performance in the year of the purchase, however, it may not be representative of the property’s future performance. Looking at a cap rate in the initial year of the purchase is similar to looking at the yield on a treasury bond. Simply put, a cap rate is the percentage return an investor would get on their money if they bought real estate and paid cash for it. It is an easy way to compare one property’s return to another property’s, even if the price, location, and type of properties being compared vary greatly. To determine a cap rate, one takes the net operating income (NOI) and divides it by the purchase price. If you have a property that nets $75,000 per year in income and the purchase price is $1,000,000, the cap rate would be 7.5% ($75,000/$1,000,000=.075).

There are many different ways of evaluating properties. Some can be very time-consuming such as developing a 10-year projected cash flow with varying expenses and income based on things like improvements made to the building and projected market shifts. Cap rates are relatively simple and can be useful when evaluating multiple properties without needing to do an in-depth analysis for each property. However, NOI needs to be vetted to make sure the data being used is accurate and representative of future potential income. The stabilized income for a property may be very different than the income reported on tax returns. For example, if we look at 2020 income on a property there is a good chance that rents were not paid in full because of the pandemic and income may have been lower than future years will be. Conversely, the owner may have received grants or incentives that were offered during the pandemic and had lower expenses than usual due to decreased occupancy. This would increase the NOI and be an anomaly that is not representative of future income. To evaluate cap rates successfully, one must use stabilized income and expenses. One would also make adjustments to add back depreciation expenses and interest expenses and make sure there was a management expense commensurate with the amount of time it takes to manage the property.

Investors often ask “what should the cap rate be?” This changes over time and depends on alternative investments. With 10-year Treasury bonds yielding just over 1%, investors may be happy with a 4-5% return on their real estate. The biggest factor in the decision of an acceptable cap rate is going to be the amount of risk. With a long-term lease on a credit-rated tenant, 4-5% may be an acceptable level of risk. If there are multiple tenants and short-term leases, the risk of vacancy is higher and the investor may demand a higher return on their money, thus desiring an 8-10% cap rate. Cap rate compression means cap rates are decreasing and prices are increasing. This is what we have seen due to decreasing rates of return on alternative investments in recent years. Capitalization rates are also influenced by many other factors such as supply and demand for space. Demand for investment real estate has been extremely high lately. When demand outstrips the supply of available spaces, prices increase and cap rates are pushed lower. The risk of inflation puts downward pressure on cap rates since investors view real estate as a hedge against inflation (rents will rise increasing NOI if there is inflation). Another important factor is the availability of money to borrow to buy a property. If it is easily available, such as the current situation, it contributes to cap rate compression. We also see different cap rates in different classes of assets. Current trends show the need for warehouse space increasing and office space decreasing. In this situation, we would expect to see lower cap rates for warehouse space than office space. The belief is that warehousing may command higher rents in the future and office rent may decrease or increase more slowly than warehouse space.

Cap rates can be a useful tool in evaluating a property as long as the data used is accurate. Determining a stabilized income using projected income and expenses may be more beneficial, although that also introduces subjectivity to what is normally a straightforward process of defining value. Investors must determine if the income stated includes all of the expenses and an accurate vacancy rate. If a building has deferred maintenance and will need capital improvements, these costs should be factored in as well. There may be a lease that is higher than the market rate or is expiring soon and a new tenant will need to be obtained. There may be excess land that increases the value but does not factor into the cap rate analysis. It is important to understand all of the factors before deciding if a building is a good value based on the cap rate. However, with a good advisor and accurate financial projections, cap rates are a good investment analysis tool and helpful when deciding where to invest.

-Dan Stiebel, CCIM

Inflation? Stagflation? What Happens if Prices Keep Climbing?

The prevailing thought about the Federal Reserve stimulating the economy with injections of newly printed money, to rebound from the COVID-19 pandemic, is that inflation will be temporary. The Fed has assured us that as production gets back to normal, prices will come down to stabilized levels and this will keep our economic engine humming as it did before the pandemic. But what if higher labor costs and rising housing expenses are the new normal and don’t come back down?

While the Fed has tools to keep inflation in check, there is a possibility that these tools (such as raising interest rates) will derail our recovery and have a negative ripple effect across the economy as it did in the early 1980s. Below are 4 reasons we may see a high rate of inflation persist over the next few years.

1. The Labor Force. Technological breakthroughs are changing the world and our labor needs are not nearly as high as they have been in the past. Every decade since the 1800’s people have been working fewer hours. Millennials and Generation Z are more focused on finding work-life balance than pursuing long work weeks. These groups now comprise the majority of the labor market and combined with the retiring baby boomers, we may find a scarcity in our labor market that keeps wage growth high. In addition, large unemployment benefits have allowed workers to remain unemployed while they search for jobs with a higher satisfaction rate than they had in the past. If wage growth leads to higher purchasing power and lower corporate profits, we could see a needed benefit for the lower-income earners. However, it is more likely profits will remain high as the additional cost of labor is passed along to consumers in the form of higher prices. This may erode any additional benefits workers see from higher wages, as their buying power remains the same or becomes lower if the cost of goods rises faster than wages.

2. The Real Estate Market. Housing prices have skyrocketed by as much as 15% this year. The Consumer Price Index, which measures inflation, deems housing an investment and does not include the cost in its reported numbers. This may cause the Fed to be slow to react to the true increase in the cost of living. Renters will see landlord’s increasing rents to adjust for higher acquisition costs. Increased prices are due to a shortage of available properties, as well as new construction costs skyrocketing due to the unavailability of materials and labor that were set off by the pandemic shut down.

3. The US Dollar. Similar to what we are seeing today, the 1970’s had high inflation, low productivity, and high unemployment — which became known as stagflation. Inflation only became under control after the Fed drastically raised interest rates, which pushed the economy into a recession in the early 1980’s. Financial markets believe this will not happen again because we are not dealing with the rising cost of oil and decoupling of the dollar from the gold standard like we were in the 1970’s. However, we have new pressures that we need to consider that may affect our recovery. Not only are we dealing with a huge increase in housing prices, but (similar to coming off the gold standard) we have new monetary instruments available in the form of cryptocurrencies, such as Bitcoin. If inflation puts the US Dollar at risk of devaluation, people may choose to buy more cryptocurrency as a hedge against the dollar, causing a loss in its purchasing power.

4. Supply Chain and International Trade. We have benefited from ‘just-in-time’ inventory for the past two decades. Products have been available as needed and shipped from whichever foreign or domestic supplier that has been able to produce and export them at the best price point. The Pandemic has made us reevaluate our reliance on this type of supply chain and there is a big push for more reliance on domestic manufacturing. While this will increase reliability for product delivery, it will also cause prices to increase as we shift manufacturing from countries with low cost of living and labor costs to our country with higher-paid workers and a higher cost of living.

Hopefully, the Fed will be correct and we will see lower prices and increased availability of products soon. However, if the above economic pressures prevail, we will see a prolonged period of inflation. If this is the case, the best investments will be in assets that can increase income without losing customers and the worst investment will be those with fixed rates of return. Investing in stocks that concentrate on consumer staples will be better than stocks with high dividend yields—and (luckily for my clients) investing in leased commercial real estate will be better than investing in opportunities such as fixed-rate bonds.

Dan Stiebel, CCIM

2021 CRE Mid-Year Market Report for Grand Traverse County

For the first half of 2021, Grand Traverse County has seen over double the commercial sales volume and number of lease transactions compared to this time last year. Marketing time (days on market) has decreased by two weeks. The number of commercial sales transactions has increased from 26 to 38.

Currently, there are 116 commercial properties for sale in Grand Traverse County. The average list price for sale is $627,137, which is higher than last years of $406,488, and inline with 2019’s average list price of $642,606. The average sale price this year is $563,336, representing an 11% discount to the property’s average asking price of $627,137. While asking prices have gone back to pre-pandemic numbers, sellers are accepting offers at larger discounts than previous years.

In the first half of 2020, our highest reported sale was $1,800,000 for the previous Bill Marsh auto dealership at 3536 N US-31 S and in 2021, our record sale was slightly higher at $1,950,000 for a two-story office building located at 534 E Front St.

Shown in the table below, sales transactions for industrial/warehouse buildings have almost doubled, offices almost tripled, and retail has decreased by half.

Another market trend that we look at is the length of time it takes to sell a property. In 2014, we averaged 445 days and in Q1-Q2 of 2021, we are down to 223 days. This represents a 50% decrease in the average time it takes to sell a property since 2014.

Although commercial properties’ days on the market are significantly longer than residential properties, the change has been significant since properties in our area are selling in less than half the time than 6+ years ago. When buyers see a good property with a fair asking price, they are moving much more quickly to make an offer and close on the property.

Trending with sales, leasing activities have also seen more activity in 2021 compared to the last three years. This year, there have been 71 leases reported in the MLS with an average sale price of $14.63/SF/YR, while 2020 only had 33 with an avg. sale price of $15.56/SF/YR. The area is seeing a strong increase in lease numbers and total sq. ft. leased across the markets, while prices per square foot have slightly decreased (see table below). The largest jump in leases has been for industrial space, but both office and retail are up from two years ago. Perhaps it is due to new people moving to the area and starting new businesses.

Overall, the largest difference between the first half of 2020 and 2021 are total sales volume and signed leases. Total sales volume for the first half of 2021 was $21,406,752 vs $9,793,600 in 2020. When we compare total sales volume by category (industrial/warehouse, office, and retail), all have significantly improved since last year except retail. In 2021, retail property sales declined by 50%; but in 2020, it was the only category to have increased in sales volume and number of transactions.

In 2019, the commercial real estate industry in the area was influenced by the hopes of recreational marijuana sales; in 2020, we began the second quarter in a pandemic; and in 2021, we have seen a new President take office and declining COVID-19 cases affecting our area. It will be interesting to see how the 2021 market closes out and what, if any, new factors shape the commercial real estate market in 2022.

Kayla Anderson, D.M.S. & D.S.A.

*NOTE: THESE FIGURES DO NOT INCLUDE COMMERCIAL VACANT LAND OR MULTI-FAMILY PROPERTIES.

A Week in the Life of a Commercial Realtor

If you looked at the physical aspect of my job, you would see it consists of phone calls, emails, texts, and meetings. Since that describes the work of over half the people I know, I started compiling a list of what I do, to differentiate my job from other office jobs. Over the past week or so, I kept a log of the activities I was involved in, and think it gives a great representation of the work that commercial real estate professionals do.

- I met with a prospective client to discuss selling her building. I evaluated her property to give her the value of the property and tell her how long it might take to sell. I also spoke to two other prospective sellers on the phone about their properties and emailed them detailed marketing plans showing how I would help sell their properties.

- I met with three groups of people to show them spaces for lease. Two were looking for office space and one was looking for a space for a new restaurant.

- I received nine calls from prospective buyers and tenants requesting information on properties that were listed for sale or lease. I sent them information on the ones they called about as well as other properties that might fit what they were looking for.

- I negotiated with a tenant on behalf of a landlord who wanted to lease space in a building.

- I helped a buyer understand the income and expenses they would incur from 3 different investment properties and determined the future net operating income the buyer would receive after accounting for new expenses, including property tax uncapping.

- I called the zoning administrator and township planner to see if a use was allowed in a certain building and what the requirements would be to change the use.

- I called an environmental company to set up a time to do a Phase I for an office property.

- I called a title company about proration of taxes for a closing and helped my buyer close on their development property.

- I called six past customers to see if they have made decisions on moving, buying, or selling.

- I wrote a letter of intent to lease a property and counseled the tenant in different lease types, build-out negotiations, due diligence items, permits needed, and lease terms to ask for.

- I ended the week doing an excel spreadsheet that showed the benefits to a land contract sale versus a lease with an option to purchase and analyzed various payment and interest rate scenarios.

So, what was missing this week? Meetings in my office and lunch with a client. Maybe those will start again soon!

Dan Stiebel, CCIM

1031 EXCHANGES MAY LOSE THEIR ALLURE

There has been a lot of conjecture that tax rates will increase over the next few years. Government spending is reaching record highs with stimulus programs aimed to combat the economic effects of Covid-19 shutdowns. President Biden has proposed eliminating the “step-up in basis” provision for inherited assets as well as eliminating the long-term capital gains tax rate. If that happens long-term gains will be taxed the same as regular income. While these proposals may not get passed, increased spending on vaccinations, social programs, environmental concerns, public infrastructure, and education will increase the pressure to raise tax rates.

If the long-term capital gains rate is eliminated and becomes the same as the ordinary income tax rate, taxes would increase from 20% to 40% for the highest earners. This may change the way investors look at tax deferred property sales, known as 1031 exchanges. This is a section of the Internal Revenue Code (IRC-1031) that allows an investor to sell a property for a gain and not pay taxes on the gain if they keep those funds with a qualified intermediary and re-invest the proceeds into a “like-kind” property within a certain time frame.

“Why wouldn’t I still want to do a 1031 exchange, isn’t it always better not to pay taxes when you don’t have to?” The answer to this depends on the investor’s time frame for holding the asset. If an investor plans to keep the replacement property for the rest of their life or keep doing exchanges, this may hold true since they will have more money available to invest in new properties. If the step-up basis is not eliminated, this is a great tax strategy for passing assets on to your offspring and heirs. However, if the property is taxed upon your death at the original basis, there will be a much larger tax bill than if taxes had been paid at the time of each sale and the basis of the inherited property was higher. Similarly, if the investor plans to sell the property and use the proceeds in their lifetime, often done to fund retirement living, the investor would have a larger gain upon sale if they completed a 1031 exchange. When the capital gains tax rate remains steady (say at 20%), this will be a net gain to the investor because they are able to use funds that would have been paid in taxes to grow their wealth.

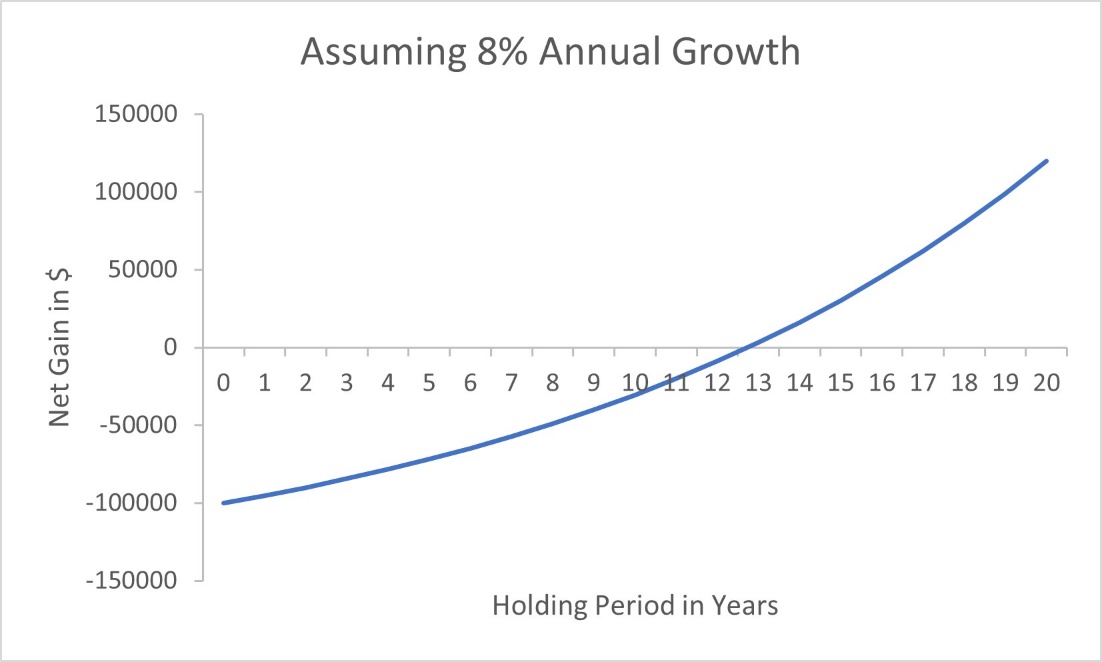

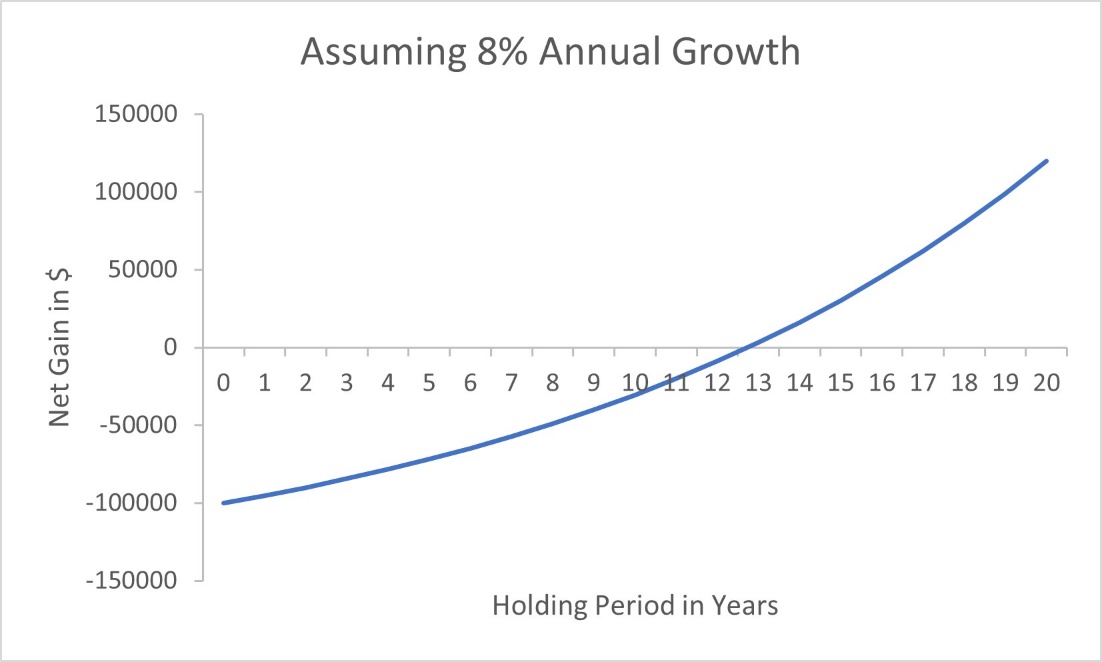

“What happens if the capital gains tax increases to 40% after I do my 1031 exchange?” The financial implication depends on how long you plan to hold the new property and on your rate of return. Take this simplified example: You sell a property and have a $500,000 gain on the property. If you pay the taxes this year at the 20% capital gains rate, you will pay $100,000 in taxes on the gain.

- If you do a 1031 exchange and buy a new property with an 8% rate of return, the $100,000 not paid in taxes would grow to $147,000 in 5 years. That’s $47,000 more than you would have had without the exchange. But if you sell the property after 5 years and the capital gains rate increases to 40%, you will now pay taxes on the original $500,000 plus the $47,000 gain at 40% which would be a tax bill of $218,800. That is $71,800 more in taxes than the original tax savings of $100,000 plus the extra $47,000 earned.

- Contrarily, if you held the same property for 15 years, the $100,000 would grow to $317,000, a $217,000 gain. If the tax rate is 40% in 15 years, you would owe taxes of $286,900 ($500,000 + $217,000 at 40%). This would net you $30,300 more than if you had not done the 1031 exchange ($317,000-$286,800).

1031 Exchange Calculator

In this example, the break-even holding period is between 12-13 years for the asset. If the investor plans to sell the replacement property and use the funds in less than 12 years, they are better off not doing the exchange. If they plan to keep it 13 years or longer, they will end up with a higher rate of return after taxes, if they do the 1031 exchange.

The break-even holding period changes based on the anticipated rate of return. For example, if we run the same scenario with a 12% annual rate of return, the investor only needs to hold the asset for 8 years before it makes financial sense to do a 1031 exchange. Likewise, a 20% return (often attainable when factoring the leverage of borrowing at today’s low interest rates) would only require a 5-year holding period before it became advantageous to do the exchange.

Tax rates will not increase to 40% for everyone (and could be more for some). In order to determine whether a 1031 exchange makes sense, each investor must project their future anticipated tax rate, the annual return on the investment, and how long they plan to own the property. I have created a basic calculator that graphs the holding period needed to return a profit on a 1031 exchange in the face of rising tax rates. If you change the input cells you can customize it to your individual situation and run multiple projections. You will also see that if tax rates remain the same or decrease, it will always be financially beneficial to do the 1031 exchange.

While 1031 exchanges have been a great wealth building tool in the past, investors must factor in the possibility of increasing taxes when determining the benefits of doing this exchange. I ran this past Jim Taylor, a CPA at DGN with a good deal of real estate tax knowledge, and he was quick to point out that tax policies change with each administration, so a change in the next 4 years would not necessarily remain the same when the investor sells. He also pointed out the following reasons and disposition strategies that might make an investor consider doing a 1031 exchange anyway:

- Live to fight another day (keep the funds) in case the tax laws change back

- Keep the ability to control income in the future to qualify for capital gains based on lower income when your income might be lower (ie retirement)

- Use installment sales to qualify for lower income by spreading out the gain

- Use a cash out refi to extract cash but continue to defer gain

- Gift / bequest the property to lower income beneficiaries and then sell to get capital gains treatment / or lower rate treatment

- Time the future sale with a deduction event (ie a big charitable deduction or investment loss)

- Use a charitable trust to contribute the property and shelter the gain

For many, the 1031 exchange will remain the best investment strategy, but for those with a shorter holding period or lower leverage and return rate, it might make more sense to pay the taxes this year and reinvest the after-tax proceeds into a new property.

Dan Stiebel, CCIM

Let’s Compromise…The Art of Negotiation

I’ve always enjoyed a good debate, conversation, or negotiation. I started honing my negotiation skills at a very young age, thanks to my mother. She would offer me a cookie and I would counter-offer by asking if I could have four or five. She would say “Why don’t you start with one or two?” In my mind I just got her to double her initial offer! I would often end up with three cookies in exchange for being a happy child, and a promise to eat my dinner. A 300% increase from the initial offer and more than enough to satisfy my desire.

Now, I find myself negotiating in so many aspects of my real estate career. It is not just the price of a property for my client nor the time frame it will take to close–the negotiations include: listing agreements, lease terms, contingencies, repairs, inspections, personal property, tax prorations, build-out costs, rent commencement dates, asking price, personal guarantees, and cost-sharing, just to name a few. Over the years, I have learned many traits of a good negotiator and skills to help my clients reach their goals.

Here are 8 tactics that will help lead to a successful outcome:

- Know their motivation. Find out what is important to the parties involved. If one party is trying to close by the end of the year for tax reasons, or close quickly to purchase another property that is available, timing may be more important to them than the price. Knowing what motivates each party will help you craft a solution that makes both parties happy with the outcome.

- Do not focus on one issue. It is not always about both parties agreeing on each issue. If you are able to give one party the terms that are most important to them, they are more likely to concede on issues that are less important to them. By negotiating multiple areas of a deal at one time, each party can feel they got what they needed to move forward. Consider a landlord that wants their building occupied at market rent. If that is their motivation, they may be willing to offer concessions to a tenant who wants the space built out to their needs and do not want to pay rent until they are ready to open for business. As long as the Landlord has a tenant paying full rent at some point in the future, they may be willing to concede on the short-term expenses to get the space ready for occupancy. By giving each party what they want you can create a win-win situation.

- Leave room to move. Don’t start with your final offer and hold firm. People like to feel they are being listened to and showing movement from your initial terms demonstrates you are hearing the other party’s needs. The initial offer should be less than you are willing to offer so there is room to compromise. Most people like to reciprocate, so when you concede on one term, the other party is more likely to concede on another term.

- Be first to make an offer. There are many debates about whether it is best to let the other party make the first offer, but I have found that whoever makes the first offer tends to get closer to their desired terms. Research has shown the initial offer has an anchoring effect and influences the other party’s response enough that the initial offeror tends to end up closer to where they want to be than the other party. The offer must be in a reasonable range, but it can be at the high end or low end depending on whether you are a buyer or seller. By setting the target, negotiations tend to center around this number.

- The Flinch Test. One of my favorite ways of determining a party’s motivation was explained to me by John Welsh, who was my first mentor in commercial real estate. It cannot be done by email or text and is best done in person, although it will work on the phone or zoom as well. You state the terms you are looking for to the other party and read their reaction. If they seem tolerant of what you say, you know you are close to what they would accept. If they have an adverse reaction (or flinch), you know you are too far off the mark. The flinch test is a great way to see if your starting point is in line with expectations.

- Have alternatives. In order to be successful in the negotiations, you must be willing to walk away from a deal. The best way to do this is to have other options. There may be something you really want, but there is a price that is too dear, and another property you will be happy with if the price were different. Keep the alternative in mind, so you do not concede to terms that are not beneficial.

- Be firm. A Harvard study from 2017 showed that being warm and caring was appreciated by others but tended to lag in the economic outcomes. A firm communication style achieved more favorable counter-offers. By stating “If you’re willing to do this…. we have a deal” ended up 8% closer to their offer price than the group that said, “I would really love it if you would be willing to do this.”

- Become an expert. People are more likely to say yes to experts with authority and knowledge in their field. By knowing the market in which you are operating, you can become the trusted advisor and recommend responses based on what the most likely outcomes will be. By knowing the market, you can craft the terms within an acceptable range that are most advantageous to your situation.

Dan Stiebel, CCIM

2020 Commercial Real Estate by the Numbers

2020 will definitely be a year to remember, although many of us may prefer to forget it. With a global pandemic, domestic political divide, global trade tension, and record unemployment, this was a year that wreaked havoc on some industries and benefited others. With restaurants, travel industry, gyms, and large event businesses all but shut-down, many businesses did not survive and are still struggling while waiting for business to return to normal. However, there were a handful of industries that benefited from the change in consumer habits such as grocery stores, delivery services, tech companies, and online services and sales.

The real estate industry had similar ups and downs. In the residential markets we saw a migration from larger cities to smaller towns that led to decreasing sales in major metro markets and a surge in sales in smaller suburban areas. Northern Michigan’s residential market was no exception and sales hit an all-time record for the number of homes sold and prices of homes. The commercial market in Northern Michigan was mixed. Transactions were very scarce the first half of the year while businesses waited to see how the pandemic would affect their industries. When business re-opened in the second half of the year we saw record low interest rates, rising stock market valuations, and pockets of industries and investors flush with cash. This lead to a strong desire to purchase real estate and the market rebounded. The year ended mixed with the largest gains in sales volume in the sectors that lost the most value in prices, such as retail.

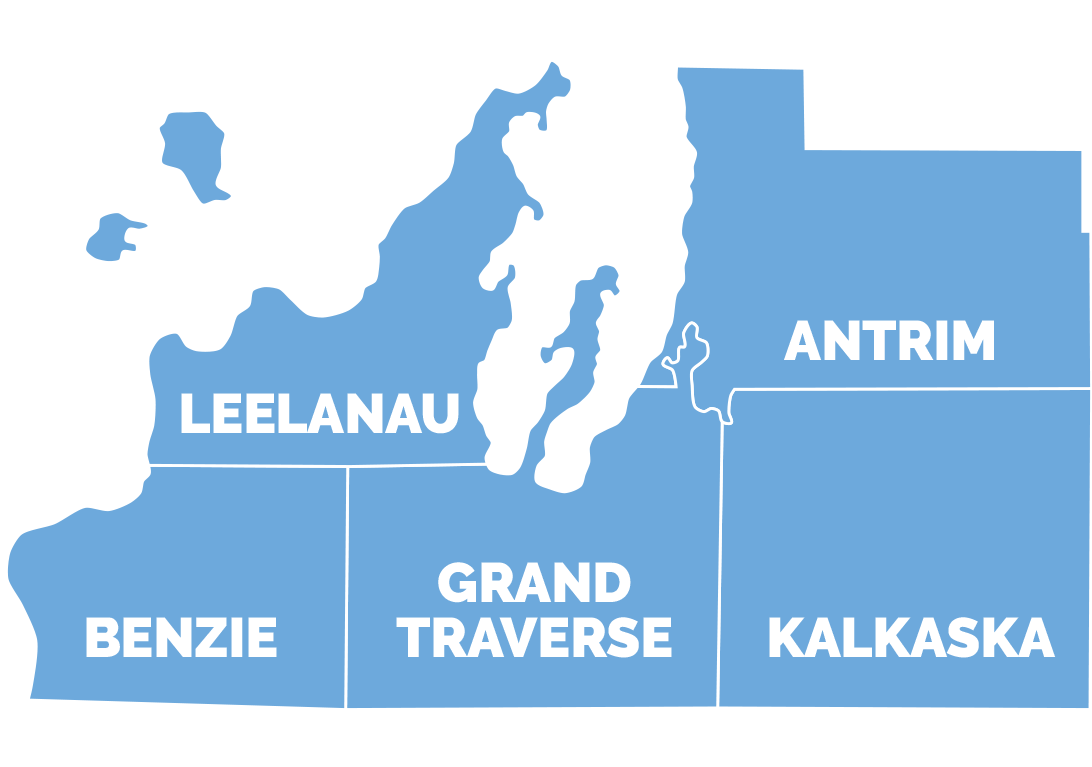

As reported in Northern Great Lakes Realtors MLS (NGLRMLS), there were 82 commercial properties sold in Grand Traverse County in 2020 (an increase from 67 the prior year). The average sale price decreased 28% from $516,400 to $371,600. It should be noted that we had a surge in sales of mini-storage condominiums that accounted for 38 of these sales. With an average price of $105,000 for mini-storage, and sales accounting for almost half of all the commercial sales for the year, it is not surprising the average sale price dropped significantly. However, the price per square foot for industrial, office and multi-family rose in 2020. Within the larger 5 county area (Grand Traverse, Leelanau, Antrim, Kalkaska & Benzie Counties), the commercial sales totaled 150 properties, which was up from 122 properties the prior year, with the average sale prices decreasing 18% to $350,000, again due to the increase in mini-storage sales.

Below is a breakdown of the commercial sales reported in NGLRMLS into the categories of industrial, office, retail, multi-family, and vacant land. This helps gain a better understanding of the values and trends of our commercial real estate based on each property type.

Industrial/Warehouse Buildings – The Industrial market remains in tight supply and prices in Grand Traverse County continued their upward trend averaging $79/square foot, a 30% increase over the previous year. However, total sales volume was down 26% and total square feet sold was down 43% to 121,500 SF of sold space. The average price for the five-county area was $55/SF which was actually a slight dip from an average of $57/SF in 2019 and total sold square footage sold was down 13%. As noted earlier, sales of mini-storage units reached an all-time high of 38 units, creating a new market that we will begin to track more closely.

Office & Medical Office – The office market showed a stronger sale price per square foot, but saw the largest decline of any sector in the amount of space sold. Grand Traverse County had 7 sales totaling 22,000 square feet compared to 2019’s 19 sales of 96,000 square feet. The five-county area saw a similar decline in sales with sales volume down 73% from the prior year. Prices rose with the average price per square foot in Grand Traverse County increasing 25% to $136/SF and the 5-county area increasing 13% to $128/SF.

Only one Medical office building was reported as sold in 2020 in the five-county area. While it is not enough data to draw any trends, the price per square foot was $143 which was down 10% from the one sale the previous year. Medical buildings continue to be difficult to sell as medial practices continue to consolidate and have pandemic related disruptions to business.

Retail – Retail prices were down 28% to $147/SF in Grand Traverse County. This helped spur sales in the sector and the total square footage sold increased 48% to 58,000 SF. Likewise, the 5-county area saw prices decrease from $160/SF to $135/SF and sales increased from 61,000 SF to 100,000 SF in 2020. Past years had inflated sale prices from marijuana dispensaries looking for locations, so 2020 marked both a return to normalcy and continued weakness in the retail sector.

Multi-Family Housing – Multi-family continued to gain in 2020, but at a more reasonable rate. In Grand Traverse County, there were 94 units sold in 2020 up from 67 the previous year. Sale prices increased 4% with the average sale price hitting $106,400 per apartment unit. New multi-family developments continue to be constructed and occupancy rates have been high. Sales in this sector continue to be limited due to a lack of available inventory for sale.

Vacant Commercial Land – Despite the pandemic, development continued throughout the downtown area with financial institutions and residential short-term rental buildings continuing to fuel the demand. Many of the development sites that sold this year were not listed in the MLS and others were not listed as vacant land because they had existing buildings that were torn down. The sales that were reported in the MLS showed about the same number of sales as the previous year and no change in the price/acre, but there were many more ‘off-market’ deals than in the past. Often when prices reach very lofty levels, sellers are willing to sell but don’t want to advertise the price that it would take to motivate them, so the properties are not listed. Like the last few years, there was a wide range of pricing, and downtown had multiple properties selling for over $100/square foot. The sites commanding the highest prices were the ones that are zoned to allow for condominiums that can be rented on a daily or weekly basis.

Leasing Activities – Leasing activity in Grand Traverse County remained fairly flat with 95 properties leased in Grand Traverse County compared to 96 the year before. The percent of properties that leased dipped down to 41% which was the lowest level since 2012. While Industrial space continued to lead in the highest volume of leases, offices were a close second. However, many of the office spaces that leased were smaller offices used by individual workers looking to get out of their homes and have their own space.

Dan Stiebel, CCIM

Cash Flow is Key: How to use Real Estate to Survive the Pandemic

In the past few weeks Moderna, Pfizer & AstraZeneca have announced promising results for three different possible Covid-19 vaccines. It will take some time to roll out these vaccines and have life return to normal, but the process is likely to begin as early as this month and by late spring of 2021 we may see wide-spread access to a vaccine.

The stock market has hit new highs and business sentiment is positive, but we still have a long winter ahead of us and some businesses may not survive. Cash flow is going to be the key concern for many businesses and anything to help conserve cash or raise additional funds will be key to survival. Here are a few real estate related ideas that can help businesses cash-flow until they can resume their normal business model.

Rent Reduction

If the business is currently in a lease, one quick way of lowering costs is to ask the landlord for a rent reduction. Chances are the landlord won’t agree unless the business offers something in return. An enticing option for the landlord may be to extend the term of the lease, so the landlord knows the tenant is committed to staying. A longer lease term may be more beneficial to a landlord than a higher rent for the next 6 months. In the great recession, many landlords used the ‘blend & extend’ option to lower tenant’s rental rates in exchange for longer lease terms.

Other options include offering higher payments at the end of the lease term in exchange for a discounted current rent. Percentage rents may also be a possibility. This is when a landlord gets a lower base rental rate but also gets a share of the sales of the business. This nets the landlord less income while business is curtailed due to covid-19 limitations, but the prospect of greater returns when business returns to normal.

Sale-Leaseback

This is a great option for cash-strapped businesses that own their real estate. The business can take advantage of investors searching for yield in a low-interest environment by selling the property at a low cap rate. This equates to a high sale price and allows the seller to utilize 100% of the asset’s available value as opposed to just 70-75% available through traditional bank debt. Sale-leasebacks are typically 10-15 year leases which means the seller retains the right to use the real estate for their business for a long time into the future.

Reimagine Space

While many employees are working from home, businesses often have underutilized space in their premises. Consider subleasing some of this extra space for a different use. For example, office demand may be low right now, but a conference room or office could be leased by an individual looking for photo studio space, a video chat room, or a student who needs access to high-speed internet. For those who own their space, they could consider converting existing space to a high demand use such as residential or manufacturing.

Buy a Building

It may seem counter-intuitive, but there are certain ways that buying a building may be less expensive than leasing right now. With interest rates at record lows, many mortgage payments are lower than lease payments, which would increase a business’ cash flow. The trick is going to be finding a building that can be purchased with little or no down payment. This may be possible through a land contract or the owner taking a note for the down-payment portion of the purchase price.

By utilizing some of these techniques a business may be able to increase its cash position. This may be the difference between surviving until the Pandemic ends and going out of business before then. As we start to see the light at the end of the tunnel, now is the time to set a road map to successfully remain in business until these difficult times pass.

Dan Stiebel, CCIM

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link